Excellent question — and one that many economists, investors, and technologists are actively debating right now.

Let’s unpack it carefully 👇

💭 Short answer:

AI has some “bubble-like” characteristics, but it’s not exactly like the dot-com bubble — at least not yet.

🧩 Similarities to the Dot-Com Bubble

Massive Hype

Just like “.com” was the buzzword of the late 1990s, “AI” is today’s magic term.

Companies are adding “AI” to their names or marketing materials to attract investment — sometimes without meaningful technology behind it.

Skyrocketing Valuations

AI startups are getting billion-dollar valuations with limited revenue or proven profitability.

Big tech stocks (like NVIDIA, Microsoft, and OpenAI’s ecosystem) have surged largely on AI excitement — similar to how Cisco, Yahoo!, and Amazon rose in 1999.

Speculative Investment

Venture capital and corporate investors are pouring huge sums into AI projects — some of which may never generate returns.

This echoes the speculative frenzy of the dot-com era.

💡 Key Differences

Real Adoption & Value Creation

Unlike many dot-com startups that had no working product, today’s AI is already producing tangible value:

Automating workflows

Enhancing productivity

Powering consumer products (ChatGPT, Copilot, Midjourney, etc.)

AI models are being used across medicine, finance, logistics, and creative industries.

Infrastructure Is Ready

In the 1990s, the internet was new and unreliable.

Today, global data infrastructure, cloud computing, and advanced chips make AI scalable and functional at a commercial level.

Sustainable Revenue Streams (for some)

Companies like NVIDIA and Microsoft are earning real profits from AI services and hardware.

That wasn’t the case for most dot-com companies.

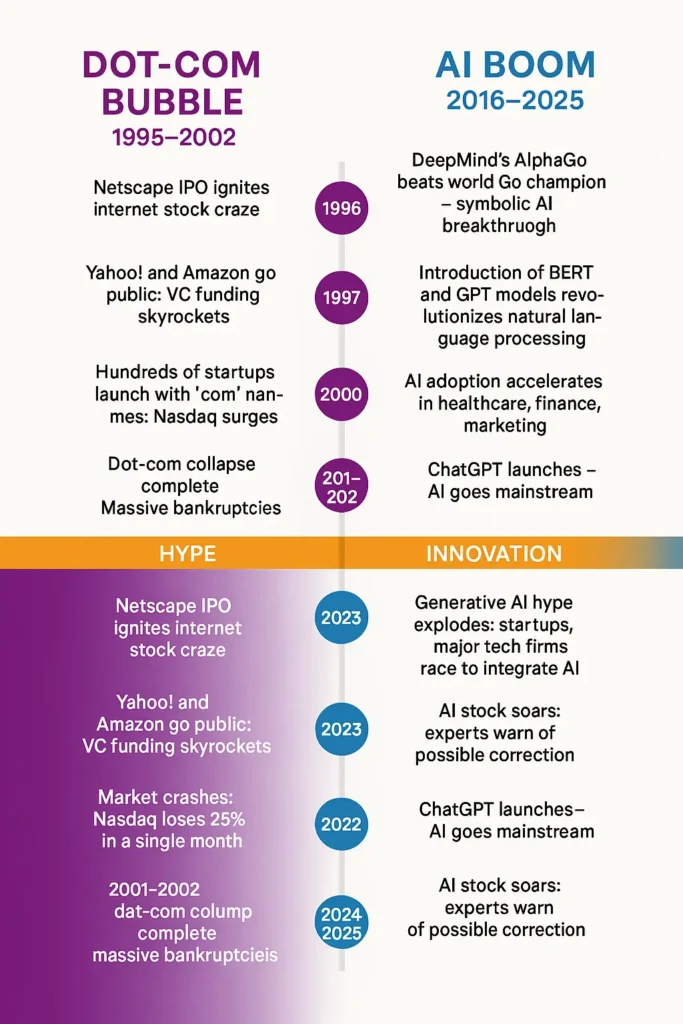

📊 1. Comparison Chart: Dot-Com Bubble vs. AI Boom

| Feature | Dot-Com Bubble (1995–2002) | AI Boom (2016–Present) |

|---|---|---|

| Core Technology | Internet & E-commerce | Artificial Intelligence & Machine Learning |

| Trigger Event | Public internet access & cheap PCs | Breakthroughs in large language models (GPT, BERT) & cloud computing |

| Peak Hype Period | 1998–2000 | 2023–2025 |

| Investment Pattern | Venture capital and IPOs in .com startups | Massive VC funding and AI infrastructure (chips, cloud, models) |

| Common Trend | Companies added “.com” to names to attract funding | Companies adding “AI” or “GenAI” to names for visibility |

| Valuation Surge | NASDAQ up 400% by 2000 | AI-related stocks (NVIDIA, MSFT) at record highs by 2025 |

| Infrastructure Readiness | Weak — slow internet, early hardware | Strong — cloud, GPUs, big data |

| Profitability of Startups | Mostly unprofitable | Mixed — some highly profitable, some speculative |

| Collapse Moment | Burst in 2000–2002 | Yet to come (possible correction expected) |

| Long-Term Winners | Amazon, Google, eBay | OpenAI, NVIDIA, Microsoft (potentially) |

| Core Lesson | Hype fades, innovation remains | Sustainable business > speculation |

🕰️ 2. Timeline: From Dot-Com to AI Boom

Dot-Com Bubble Timeline (1995–2002)

1995: Netscape IPO ignites the internet stock craze.

1997: Yahoo! and Amazon go public; VC funding skyrockets.

1999: Hundreds of startups launch with “.com” names; NASDAQ surges.

2000: Market crashes; NASDAQ loses 25% in a single month.

2001–2002: Massive bankruptcies; dot-com collapse complete.

2004–2005: Google and Amazon recover and dominate the new web economy.

AI Boom Timeline (2016–2025)

2016: DeepMind’s AlphaGo beats the world Go champion — a symbolic AI breakthrough.

2018: Introduction of BERT and GPT models revolutionizes natural language processing.

2020: AI adoption accelerates in healthcare, finance, and marketing.

2022: ChatGPT launches — AI goes mainstream.

2023: Generative AI hype explodes; startups and major tech firms race to integrate AI.

2024–2025: AI stock valuations soar; governments begin regulating AI; experts warn of a possible correction.

⚖️ So… Is It a Bubble?

👉 Partly, yes — but not entirely.

We may be in an AI investment bubble — where valuations exceed realistic expectations — but AI as a technology is real and transformative.

What’s likely:

Some overvalued startups will collapse (like Pets.com did in 2000).

But the survivors will reshape the global economy — just as Amazon and Google did after the dot-com crash.

🧠 In Summary

| Aspect | Dot-Com Bubble | AI Boom |

|---|---|---|

| Core Technology | Internet | Artificial Intelligence |

| Hype Level | Extreme | High |

| Real Utility | Limited early on | Already substantial |

| Valuations | Mostly speculative | Mixed — some justified |

| Survivors | Amazon, Google | NVIDIA, OpenAI, Microsoft? |

| Outcome | Massive crash, long-term transformation | Possible correction, lasting impact |

⚖️ So… Is It a Bubble?

👉 Partly, yes — but not entirely.

We may be in an AI investment bubble — where valuations exceed realistic expectations — but AI as a technology is real and transformative.

What’s likely:

Some overvalued startups will collapse (like Pets.com did in 2000).

But the survivors will reshape the global economy — just as Amazon and Google did after the dot-com crash.

The Republic News News for Everyone | News Aggregator

The Republic News News for Everyone | News Aggregator